Professional athletes are in the top-most echelons of the world’s most driven, talented and hard-working humans. Yet, they have extremely short-lived careers. Hence, pro athletes need to act with urgency to make their incomes last a lifetime.

To do so, they need an experienced athlete financial advisor by their side – for contract negotiations, sponsorship analyses, risk management, tax strategies, investment advice, and more. Make no mistake – any old CPA or financial advisor will not do; you must get someone who understands the business of sports and has worked extensively with professional athletes.

Athletic Careers Are Short-Lived, On Average

Professional athletic careers typically start young, when most athletes are in their late teens or early twenties. The sad part, though, is that athletic careers are relatively short-lived for the most part, and, on average, fizzle out in less than six years. This extremely short span underscores the burning urgency of having a really good athlete financial advisor by your side, ideally, while you’re looking at your contract options and before you sign your first contract, but better late than never if you don’t already have an advisor.

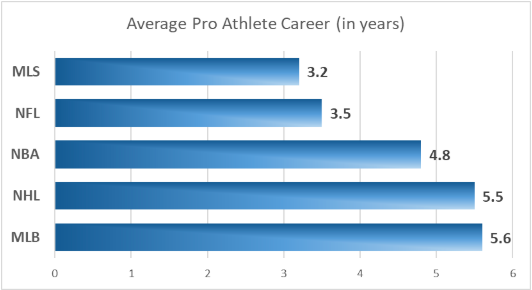

While sporting legends such as Kobe Bryant, Michael Jordan, Tom Brady and Wayne Gretzky, stand out for their long, illustrious careers, the chart below reflects a sobering reality.

Pro baseball players (MLB) have the longest average career span at 5.6 years, followed by NHL at 5.5 years, NBA at 4.8 years, NFL at just 3.5 years (blame it on the injuries), and MLS at a mere 3.2 years.

Professional athletes in other fields – golf, tennis, gymnastics, ice skating, etc. – face similar issues and need to hire a financial advisor who has considerable experience in their sports.

Consider an NBA player. He’s middle-of-the-pack with an average career span of 4.8 years of professional earnings (likely before the age of 25 or so) which are supposed to last him a lifetime unless he’s willing to take on another viable career after he exits the NBA.

The good news is that the median salary of an NBA player is $2.5 million per year. Multiply that by 4.8 years, and you’re looking at a cool $12 million, which is way above what most Americans make in their entire lifetimes. Clearly, $12 million is enough to live a really comfortable life provided you are careful with your budgeting and investments and do not blow it all on excesses.

But to make your money last for a lifetime, you need an expert athlete financial advisor by your side, even before you sign your first contract.

Contract & Sponsorship Negotiation Analysis

Professional organizations recruit players every year, and they’ve been doing so for decades. They have fixed player recruitment and salary budgets each year, and have no interest in paying you a dime more than the lowest they can get you for. Their lawyers are experts in the art of negotiation, and could easily bully a young kid and his parents into signing a raw deal. As a professional athlete, you want to make sure you’re not naïve but are well prepared and well represented.

You’d be harming yourself if you rely on your parents to negotiate on your behalf, or on a friend who had his son recruited. The best way to prepare yourself is to pick an athlete financial advisor who has decades of experience working for athletes, not for teams. You want someone who is batting for you, not for the fat-cat team owners.

A good advisor will assess your situation, understand where you rank in the pool of recruits, and come up with a reasonable valuation for your skills (sort of like assessing the value of a home before you sell it). In so doing, your advisor puts you in a much stronger negotiation position because he’s done his homework and has data to back up his asking price, making it much more likely that you’d be paid millions more based on what you’re truly worth.

An advisor also acts as a buffer between you and the team and keeps you away from the hardball tactics and bitterness of negotiations. Moreover, in picking a good athlete financial advisor, you’re sending a signal to the team that you have experts on your side, so they are less likely to undercut you (think of robbers who skip a well-protected home and move on to the least protected, easiest target).

As your career progresses and you make a name for yourself, sponsors may want you to promote their merchandise and services. Here again, a good financial advisor will have your back, and negotiate a deal that pays you fair market price and nothing less.

Establish Salaries & Administer Payroll for Your Aides

Most pro athletes have a small personal team that works with them on various things. Again, your financial advisor will enter into written employment contracts and non-disclosure agreements that protect you, your finances, and your privacy. S/he’ll establish and administer salaries, benefits and payroll, file IRS forms to report employee income and employer taxes, maintain your bank account so receivables and payables are managed, and take care of all the financial aspects for you.

Risk Management to Protect Against Potential Liabilities

Another sad truth is that professional athletes have higher divorce rates than the general population. These divorces can, literally, bankrupt you, especially if you have to pay child support in addition to alimony. When dealing with pro athletes, divorce lawyers see big dollar signs which make them come after you for all you’ve got (remember, the lawyers get paid based on how much they can get for their clients).

A good athlete financial advisor will protect you on this front too, by making sure you have a pre-nuptial agreement in place before you walk down the aisle. While we all believe in eternal love, if you’re marrying the right person, she’ll understand that you have to protect your own best interests; if she doesn’t, she likely wasn’t that into you and was probably marrying you for the fame and fortune. Heck, even if she’s genuinely into you, you yourself may end up having an affair with someone who throws herself at you. So it’s best to be protected – from others and from yourself.

But risk management doesn’t stop there.

If your maid or babysitter or assistant slips on the floor of your home or office, they could sue you for millions.

If you injure yourself and cannot play for a season or, god forbid, for life, your finances could turn upside down in a split second.

An experienced financial advisor has seen it all (sort of like Farmers Insurance’s tagline, “We know a thing or two because we’ve seen a thing or two.”) and will make sure you have the right umbrella and other insurance policies in place to reduce your potential liabilities on multiple fronts.

Entity Strategy & Management

Going back to the NBA example, you will have to pay taxes on your $12 million and on any additional earnings you have. While a simple IRS Form 1040 could make you pay a hefty sum, an experienced athlete financial advisor will guide you into setting up business entities (such as Delaware or Wyoming holding companies, LLCs, etc.) so you defer your income, maximize your allowable expenses, minimize what you pay in taxes, and get added layers of protection against lawsuits and other potential liabilities.

For instance, if you invest in a multi-unit income-generating property, your advisor will likely set this up in an LLC and handle all the administration, such as making sure rental checks and maintenance expenses are managed through the LLC’s bank account. Now, should one of your tenants sue you, the tenant’s claims against you will only be limited to the LLC’s assets or to withdrawals that you voluntarily take out of the LLC, leaving the rest of your assets safe. If your assets are well protected, litigants are more likely to reach reasonable settlements out of court.

Your advisor will also manage these entities so there are proper operating agreements, regular annual or quarterly meetings with written minutes, related tax-deductible expenses, periodic filings of entity fees, and everything else needed to manage your business organization.

Tax Reduction and Tax Preparation Strategies

As stated above, an experienced athlete financial planner will set up business entities as part of a comprehensive tax planning and liability reduction strategy.

In addition to lowering your taxes through deferred investments (such as a 401k retirement account), your advisor will provide sound investment advice. An advisor’s investment strategies will focus on diversifying your assets based on your age and cash flow needs, investing on your behalf as a fiduciary, making sure you have monthly income through interest or dividends, and positioning you to take advantage of compounding your returns over time.

Here’s a simple example of the magic of compounding:

Assume that at age 25, you invest $1 million in a market index fund (such as the S&P 500) that returns 6% per year on average. If you leave this investment untouched for 35 years, it would grow to $7.7 million by the time you hit the retirement age of 60. If you do even better and sock away $3 million at age 25, you’ll be sitting pretty with $23 million by the time you reach the age of 60. If you invest sooner, compounding will work to your benefit even more, and smart athletes understand this.

If you start young, time is on your side, and a good advisor will make sure s/he develops the right investment strategy so you have enough for day to day expenses for the rest of your life, have enough for retirement and can take care of your family along the way, such as paying for college.

Your advisor will also make sure s/he tracks your earnings in every state and files personal and corporate taxes in multiple jurisdictions as needed, so the IRS doesn’t come after you.

Time Isn’t On Your Side, Don’t Wait To Get an Athlete Financial Advisor

The example we looked at above was for an average NBA career. If you’re in the NFL or the MLS, you have fewer earning years, and it’s even more imperative that you do all you can to prepare for life after your pro career ends.

If you’re in the MLB, the NHL, or any other professional sport, don’t get fooled into thinking you can take it easy, because you never know when injury or some other unfortunate occurrence may strike and put you temporarily or permanently out of work or hit your finances. If you’re a sports professional, act now and get yourself an experienced fiduciary athlete financial advisor so you have the invaluable peace of mind of knowing that you’ll be financially secure and can focus all of your energies on rising to the top of your chosen sport.